- Home

- Buyers

Buyers

Unleash the Potential of Passive Selling

If you’re a large, well-funded company or private equity firm searching for off-market, strategic investments, you’ve come to the right place. As a member of our email list, you will have the exclusive benefit of being the first to hear about off-market possibilities that align precisely with your investment objectives. Examples of these opportunities include software firms for sale, lower-middle market-sized service-based businesses for sale, and SaaS enterprises for sale.

These unadvertised off-market chances provide you a competitive edge by allowing you to research and investigate possible purchases without the same amount of competition as opportunities that are posted.

1. Selected and Ready-to-Go Companies for Sale

When it comes to the businesses we offer for sale, including software firms and SaaS enterprises, we thoroughly vet and prepare each opportunity. Our staff does thorough due diligence to make sure the businesses and owners of the lower middle market companies for sale meet our high requirements for quality, financial stability, and growth potential.

We look closely at their clients, development prospects, market positioning, financial situation, and other crucial factors. You may be certain that the companies you get have been carefully screened and presented in an orderly and professional way by subscribing to our list.

2. Benefits of Off-Market Companies for Sale

Off-market businesses for sale provide purchasers such as yourself some distinct advantages. First, they provide exclusivity. Your chances of securing a transaction with favourable terms are boosted by the prospects’ widespread market accessibility and lack of competition.

You have the ability to evaluate and pursue these firms before they become generally accessible to prospective buyers, giving you a competitive edge. Secondly, off-market businesses usually give you more room to negotiate. It’s possible that sellers will be more accommodating to unique contract types and specific buyer requests.

This flexibility may lead to better terms and prices, enabling you to create a package that aligns with your investing philosophies. Finally, off-market agreements may save money since they avoid a competitive auction process. You may profit from these advantages by utilising our email distribution list to have access to off-market possibilities.

3. Crucial Domains of Vigilance

While evaluating the operational, legal, and financial aspects of the prospective software firm, due diligence is crucial. Our team is skilled at creating the necessary paperwork for each of these significant areas. Key aspects requiring attention to detail are as follows:

Financial due diligence: Tax returns, bank statements, and previous financial records may all be examined and analysed.

Operational due diligence include assessing the target organization’s technical infrastructure, scalability, clientele, KPIs, growth potential, operational effectiveness, and risks.

Legal Due Diligence: As part of your due diligence, review contracts, intellectual property rights, regulatory compliance, potential legal liabilities, litigation patterns, and other legal concerns that could have an impact on the purchase.

4. Value Generation and Integration Following Acquisition

We collaborate with you to align technology systems, optimise processes, and foster cultural coherence as part of your post-acquisition integration strategy because we recognise the importance of post-acquisition integration and value generation.

Our goal is to facilitate the transfer and make it simpler to capitalise on opportunities for development and synergy. With our resources and experience, you can effectively manage the post-acquisition process and add value to your company.

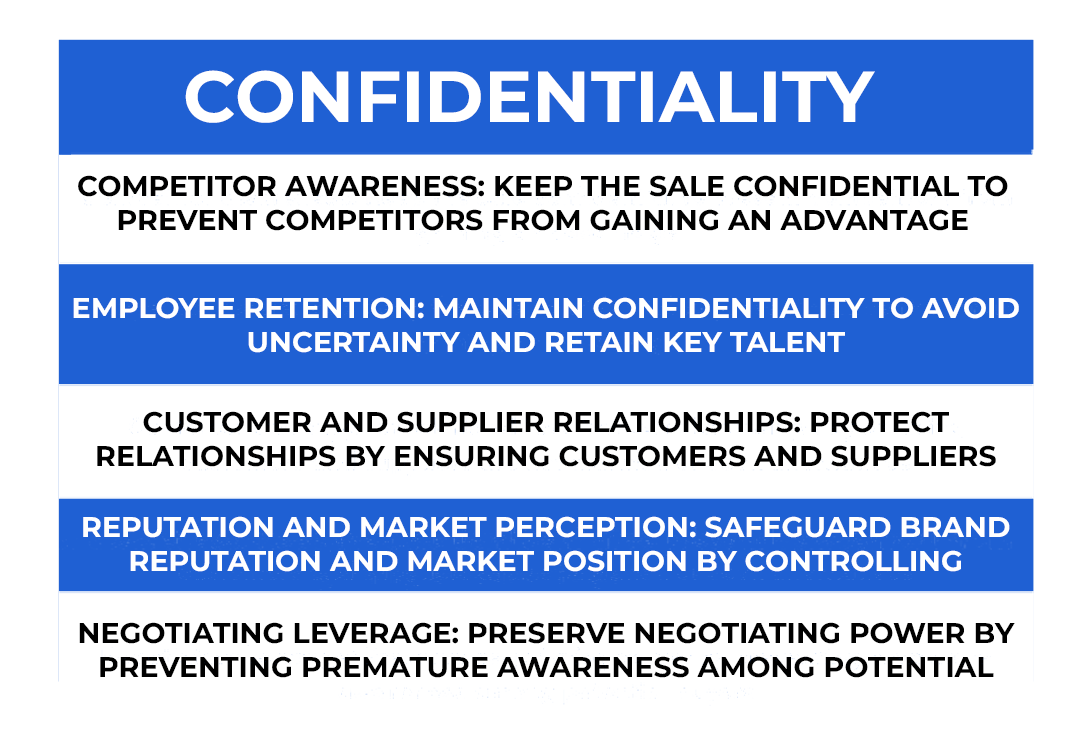

5. Privacy & Confidentiality

We understand how crucial privacy and secrecy are throughout the purchasing process. We protect our subscribers’ privacy and run our email distribution list with the strictest discretion.You may be certain that all information about you and your involvement will be kept completely confidential. We adhere to industry best practices to protect your personal information and provide a secure environment for communication and transaction review. Your trust and privacy are very important to us.